Life-Changing Power of Long Term Plans

4 plans I created: Savings Plan to retire, Business Plan for impact, Travel Plan to see the world, and a 40-Year Health Plan to stay fit through age 95 — Key actions you can take now to plan ahead

Hello, it’s Ethan & Jason. Welcome to a *paid subscriber-only* edition of Level Up: Your source for executive insights, high performance habits, and specific career growth actions.

For more, explore our intensive course on How to Break Through to Executive (next cohort starts April 26).

If you are not a paid subscriber, here’s popular articles you missed:

How you start a new role influences your success in that role: 4 immediate actions you can take

4 Behaviors of Top CEOs: Deciding with speed and conviction; Engaging for impact; Adapting proactively; and Delivering reliably

Clear long-term plans let me “retire” as an Amazon VP at 50, travel 5 months a year, and still make money.

Here is a model for how to build your long-term path to both happiness and freedom:

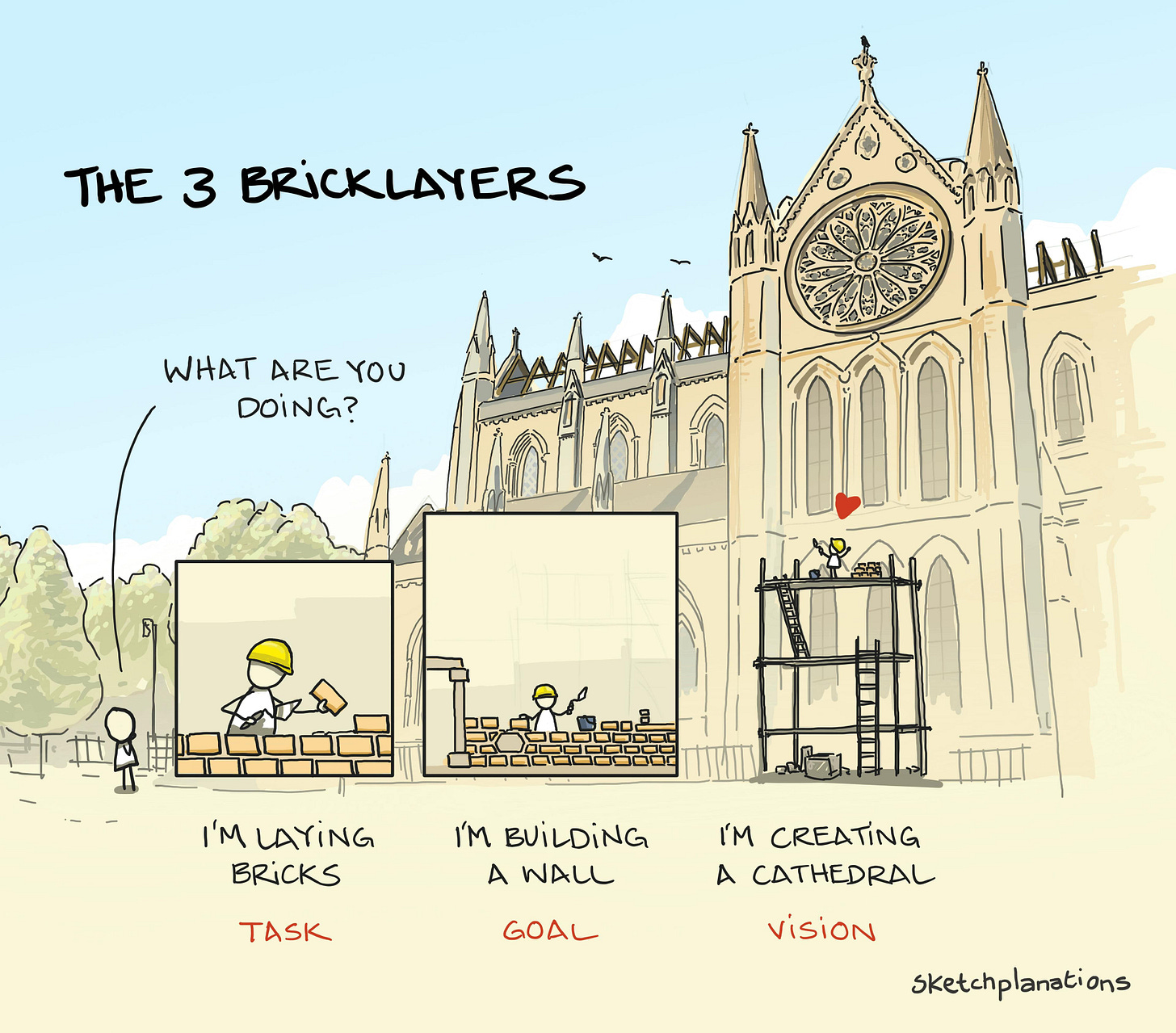

Bill Gates said, “Most people overestimate what they can do in one year but underestimate what they can do in 10 years.”

I agree with this, and I also took inspiration from Jeff Bezos, who said that he is working on plans that only his grandchildren will see to completion.

Once I started creating longer-term plans, I realized how powerful they can be.

I will share four of my long-term plans as clear examples across personal finance, business, travel, and health. Along the way, I will tell you how to construct your own.

My long-term plans:

The 5-year savings plan that let me retire.

My 10-year plan for my personal business.

My 10-year plan to see the world.

My new 40-year plan for a healthy life to age 95 (I have about a 45% chance to live that long). My most ambitious plan is literally a plan for the rest of my life.

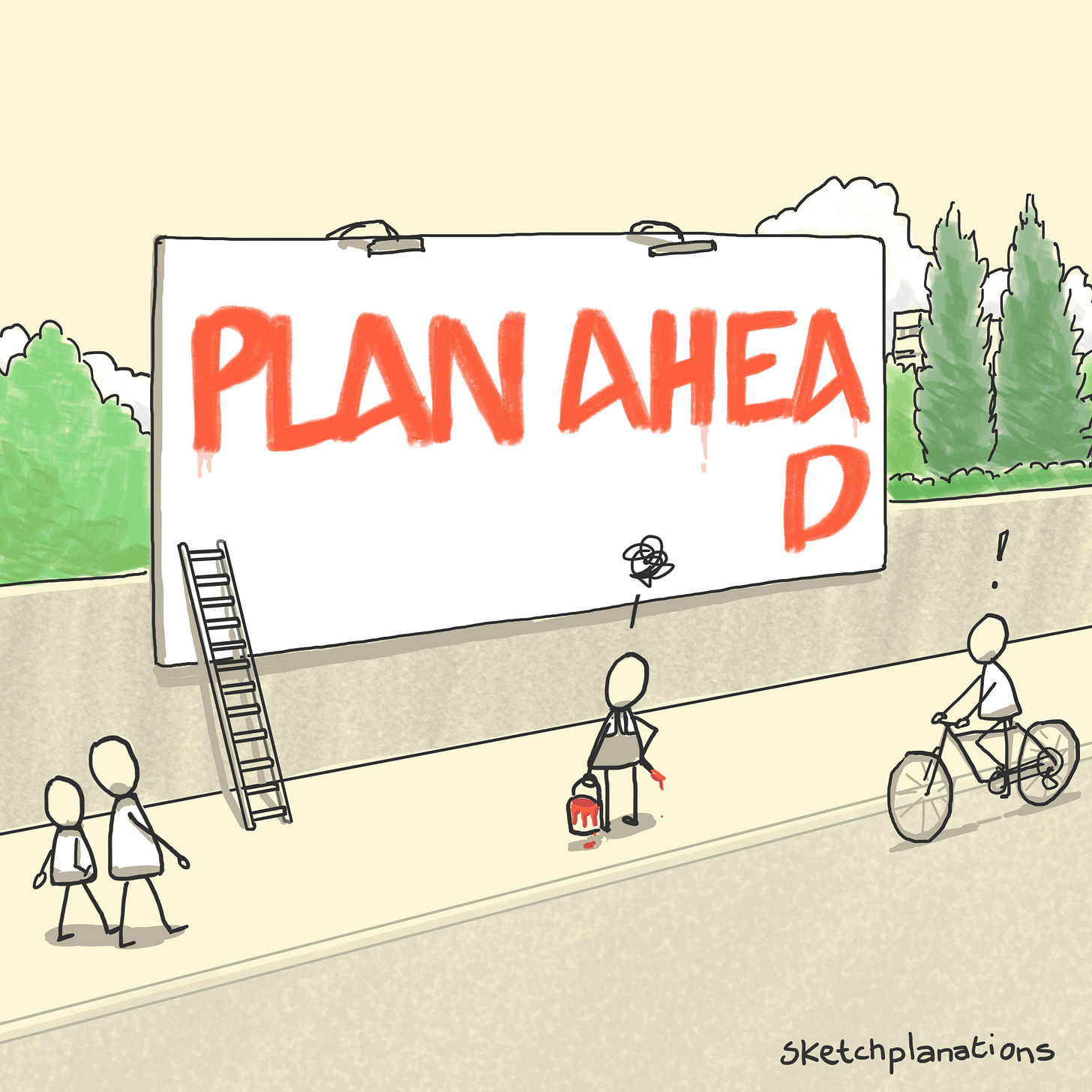

Before I dive into the details of my plans, here are specific tips you can take now to create powerful long-term plans:

Decide what area to focus on (my four plans were financial, business, travel, and health). Trying to create a single holistic life and career plan at this scale is likely too complex. Take it on in pieces.

Figure out where you want to be in 5, 10, or 40 years. What is the ultimate goal.

Work backwards from the end as well as forward from where you are. Meet in the middle.

Iterate. You can draft the plan all in one sitting, but these plans benefit from periodic revision. I have clarified, updated, and changed all of my plans once to twice a year. The end goals have rarely to never changed, but the next steps and priorities within the plan definitely do.

Be flexible. The plan exists to help you, not to constrain you.

Plan 1: The 5-Year Savings Plan that Let Me Retire

My first long-term plan was a five-year plan to “save up” and retire from Amazon to do whatever I wanted. You may be at a different place in your life and career, and will need more time than 5 years. That is good, it likely means you are starting earlier.

Before I formed my specific five-year plan, I still had a financial “plan” that took the form of three basic items:

Live on less than I make; save the difference.

Invest conservatively for the long term in equities (S&P 500 Index or equivalent).

Maximize my 401 (k) match.

As my savings and investments grew, I started to realize that I was getting close to being able to retire. So, I calculated what financial planners call “your number,” or the amount of assets you will need to live the rest of your life. Google will tell you more about this, but I followed the “4% rule,” which says that you can safely spend 4% of whatever you have saved (invested) each year, and likely your savings will last the rest of your life (because they will grow faster than your spending and inflation decreases them).

When I calculated how long, at my current savings rate and an average growth rate, it would take for my assets to reach this number, it was about 5 years.

Thus, my plan was five years long not because I set a goal to retire in five years and figured out how to do so, but rather I figured out a plan to retire, and it was going to take about five years to achieve.

But, no plan survives contact with reality. I got married and created a blended family with three additional children. This changed my cost model, as I now had to plan for a larger house and supporting three kids through adulthood.

When my wife and I recalculated, we decided it made sense to add between 2 and 3 years of savings. Ultimately, I retired in 2020, about 7.5 years into my 5 year plan.

I share this to illustrate a key point of long-term plans: Circumstances will inevitably change over the course of a multi-year plan, and so the plan will have to evolve. However, many people take this as a reason not to plan at all, which is a mistake.

If I hadn’t formed a plan, simply working and saving without any thought about how much is enough, I would not have had the clarity to start thinking about what I wanted to do in my life after my Amazon career.

If you want to go deeper on finances, read 10 simple steps to build wealth and retire early.

Long-term plans give us direction and clarity today, allowing us to make the most of the future.

Plan 2: My 10-year business plan and the impact I want to have in my “retirement”

I created this 10-year plan in 2022, shortly after I retired from Amazon in the fall of 2020. I was specifically following Bill Gates' idea of planning for a 10-year impact.

Three years in, the plan is exceeding my expectations in many ways.

My mission is: "To pay forward my good fortune by helping others find success and satisfaction in their careers."

You are reading this as a result of this mission, and I appreciate all 140,000+ of you who do so! What you may not know is that I have at least 7 more years of plans and goals for how to help you succeed.

The ultimate goals include things like:

Routinely reach one million people

Do more public speaking and teaching

Write at least one book (in progress)

Build a company that can outlive my personal involvement (continue the mission)

Transition from attracting people who want career success to helping people focus on career satisfaction

As with my financial plan to retire, I expect this plan to adapt and change with time.

The key with a 10-year plan is not to be rigid, but to have clarity on your goals and what gets you closer to them.

As Jeff Bezos said, you must be stubborn on the vision and flexible on the details. This way, you can evaluate what is in line with the goal and what is not.

My business plan has been flexible so far in the following ways:

A partner and a newsletter allowed me to scale the mission, so when the chance arose, I added them.

One-on-one coaching is great, but ultimately does not scale. As classes and the newsletter took off, I needed to cut way back on coaching to maximize my 10-year impact.

Plan 3: See the World

My third long-range plan is to see the world in my fifties while I am still very healthy and active. I made this plan at the same time as my business plan, in 2022.

To make this plan, I first made a list of all the places I knew I wanted to go. I am about three years into this plan, and it is going well. I’ve visited many nice places, including the Galapagos islands, Iceland, and Switzerland.

However, it is worth pointing out that this 10-year plan has been made possible by the success of my first plan, the one to save money and retire. By retiring, I have more time to travel as well as the money to do so.

The keys to this plan are:

Have the money. For me, this was the success of “plan 1,” to retire. But, I have a friend who backpacked around the entire world, visiting 60 countries over 18 months, and spent just $30,000 to do it. I know another couple who fixed up a boat and sailed it around the world for 8 years for $30,000 a year. Money helps, but you can travel much of the world very cheaply.

Talk to your significant other, family, and friends. Personal dreams like this usually impact others. Get them onboard!

Figure out the time and money budget for your dreams. How much time will it take and how much will it cost?

Plan 4: Remain Healthy into my 90s

My newest plan is for the whole 40 years between age 55 and, hopefully, age 95.

This may seem extreme, but I want to illustrate the power and reasons to bother with long-term planning, whether it is on a 10-year or 40-year horizon.

My 40-year plan is focused around something called "health span," which is the idea of not just living longer, but of maximizing the amount of time that you are well and able. Few people want to spend 10 years in a nursing home.

I was inspired to create this plan, the longest-term plan of all, based on the book Outlive, by Peter Attia, MD. The book is about how to avoid chronic disease and raise your odds of outliving the average life span. More importantly, however, it is about how to be healthier during all those extra years.

While the book covers diet, mental health, and ways to prevent or cure disease, the real key is something Dr. Attia calls “the Centenarian Decathlon.”

The idea here is to figure out what activities you still want to be able to do as you go through your 90s and approach age 100, and to begin training your body towards them now.

Example activities include:

Climb a set of stairs on your own

Put a carry-on bag up into an overhead bin

Lift a grandchild (or great-grandchild) off the floor

Get up off the floor yourself if you fall

Carry a bag of groceries a few blocks from the store

While these may seem easy to most middle-aged readers, if you know any 90-year-olds, you probably realize that many of them cannot do any of these things.

Because we know how things like aerobic capacity and muscle strength decline over time, it is actually possible to calculate what you need to be able to do today to be “on track” to be able to do the things on your list in the future. For example, if you want to be able to lift a 30-pound suitcase at age 100, you should be able to lift a 75-pound suitcase at age 50.

As an enormous bonus, being more fit and healthy today will allow you to do more during the years between now and age 100 (or 95). For me, getting fit for my 90s will also help me to complete my current 10-year plans in style.