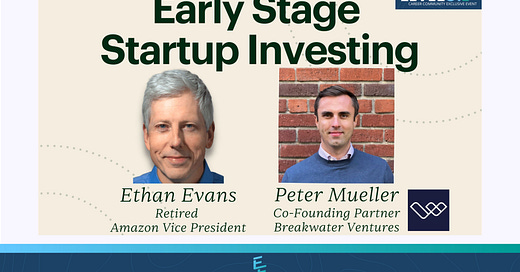

Early Stage Startup Investing with Peter Mueller (Co-Founding Partner at Breakwater Ventures)

Chat with Peter Mueller (Co-Founding Partner at Breakwater Ventures)

Welcome to this week’s free article of Level Up: Your source for career growth solutions & community by retired Amazon Vice President, Ethan Evans. If you’d like to become a paid member, see the benefits here, and feel free to use this expense template to ask your manager.

We have 2 upcoming events exclusive to paid members (RSVP below):

July 2: Level Up Virtual Networking Event (RSVP link here)

July 8: Ethan answers top submitted questions and live Q&A (RSVP here)

Note: We will observe the 4th of July holiday, so we will see you next week!

Peter Mueller — is the Co-Founding Partner at Breakwater Ventures, a pre-seed and seed fund that invests in exceptional founding teams across the US and Canada with a preference for founding teams in the Pacific Northwest and Western Canada.

Before starting Breakwater, Peter was a Partner at SeaChange Fund, an early employee at Carta, an Equity Research Analyst covering TMT (Technology, Media, Telecom) at Merrill Lynch, and worked at several private equity firms.

Ethan and Peter’s friendship started with Peter commenting on Ethan's Twitch streams that then turned into "Twitch Tank" (Shark Tank style show for Twitch) where contestants presented ideas to Ethan, Peter, and Devin Nash to get live feedback.

In our fireside chat, Peter and Ethan discuss:

Peter's investment thesis and how he picks winners as a VC.

What do founders need to do to get funded?

AI hype and investment trends.

How to approach a VC and the importance of warm intros.

What makes a good/bad VC pitch?

Note: Live attendance was exclusive to paid newsletter members.

Takeaways

(1) A venture-scale business: Triple, Triple Triple, Double, Double.

Broadly speaking, VCs look for companies that can triple the first year, triple the second, triple the third year, double the fourth year, and double the fifth year. Signals velocity and scalability.

You can bootstrap into a venture-scale business. VC is fuel for the fire.

Read my Q&A on angel investing and how I would pick the next Amazon.

(2) Signs your VC pitch went well and is going somewhere.

When VCs ask for customer contact information to talk to them and more deliverables (there must be a clear exchange of information).

You are dead in the water if you are told “Hey, this is great, we’ll get back to you” and do not hear anything in a week.

Remember, VCs have zero incentive to tell you “no”.

My thoughts on what it takes to start your own company.

(3) Do’s and Dont’s when pitching Peter.

Do’s:

Warm intros move you to the top of the stack.

Build relationships in advance (before you need them).

A strong network is your most powerful, portable long-term career asset. If you want to learn how leaders build great networks and use them to their advantage, consider my on-demand course, Leadership Networking.

The best cold emails are 3-4 sentences:

Introduce yourself.

High-level idea of the company.

Traction (e.g. number of people you’ve talked to, revenue, design partners, etc).

Be clear on what your intent for a call is.

Link your deck or even better a 1min Loom link running through your company/product/pitch.

Calendar link for Peter to quickly schedule a follow-up if interested.

To put this in perspective: Peter and team will review ~200 pitches for every 1 deal they do.

Don’ts:

If you see Peter at an event, do not go straight to “Hello, here’s my 90-second pitch.” Instead, introduce yourself, share what you are working on, start a back-and-forth dialogue, and then ask for a follow-up to go deep.

Do not email a 6-page document explaining everything about your company.

No cold calls.

Signals a breach of respect.

Peter’s schedule is packed Monday-Friday and weekends are catch-up days.

If you have a 20min meeting, do not spend all 20min pitching (10min at most).

(4) Peter believes AI is an aggregation-centric technology.

All value will end up accruing to companies who own the large language models (LLMs).

(5) If you are not building something proprietary in AI, then you are not true AI.

The AI hype is real but you must back it up when an investor asks to look under the hood (your AI architecture).

VCs understand that whatever you are building will have some AI augmentation. Pitches that go well have some aspect of selling AI as a kicker.

(6) Untapped niches in Hardware Tech, FemTech, and Vertical SaaS.

Find a market that is still using yellow legal pads and Excel spreadsheets.

There are many markets not well served with good software or apps (e.g. markets dominated by business owners who are now in retirement age and have tech-savvy Millennial children who will take over).

(7) Seattle and Vancouver have two advantages: Deep tech talent and the absence of competitive angel and institutional funds.

Follow Peter on LinkedIn and check out Breakwater Ventures.

If you want to go in-depth on what a Series B Co-Founder looks for when hiring their executive/leadership team, watch the fireside chat with Dee Murthy (Co-Founder, Ghost -raised $20M Series A and $30M Series B) and read the takeaways:

Live Event: Career Q&A with Ethan Evans

Level Up newsletter paid members are invited to join this live event where Ethan will answer your top career questions (30min answering curated pre-submitted questions and 30min+ live Q&A).

If you have a burning career question for Ethan, this is your event.

Watch this clip of Ethan from the previous Q&A. In the full 60-minute talk, Ethan answers 11 popular career questions followed by live audience Q&A.

Connect With Ethan & Jason

Ethan’s leadership development courses to go in-depth:

Level Up Newsletter & Community

Existing paid members, read the latest member-only weekly update (includes the link to join our private Slack community).

If you want to join, read about member benefits.

Level Up is your source for career growth solutions & community by retired Amazon Vice President, Ethan Evans.